Which Clearing House Settles Mobile App Payments

What Is The Payment System?

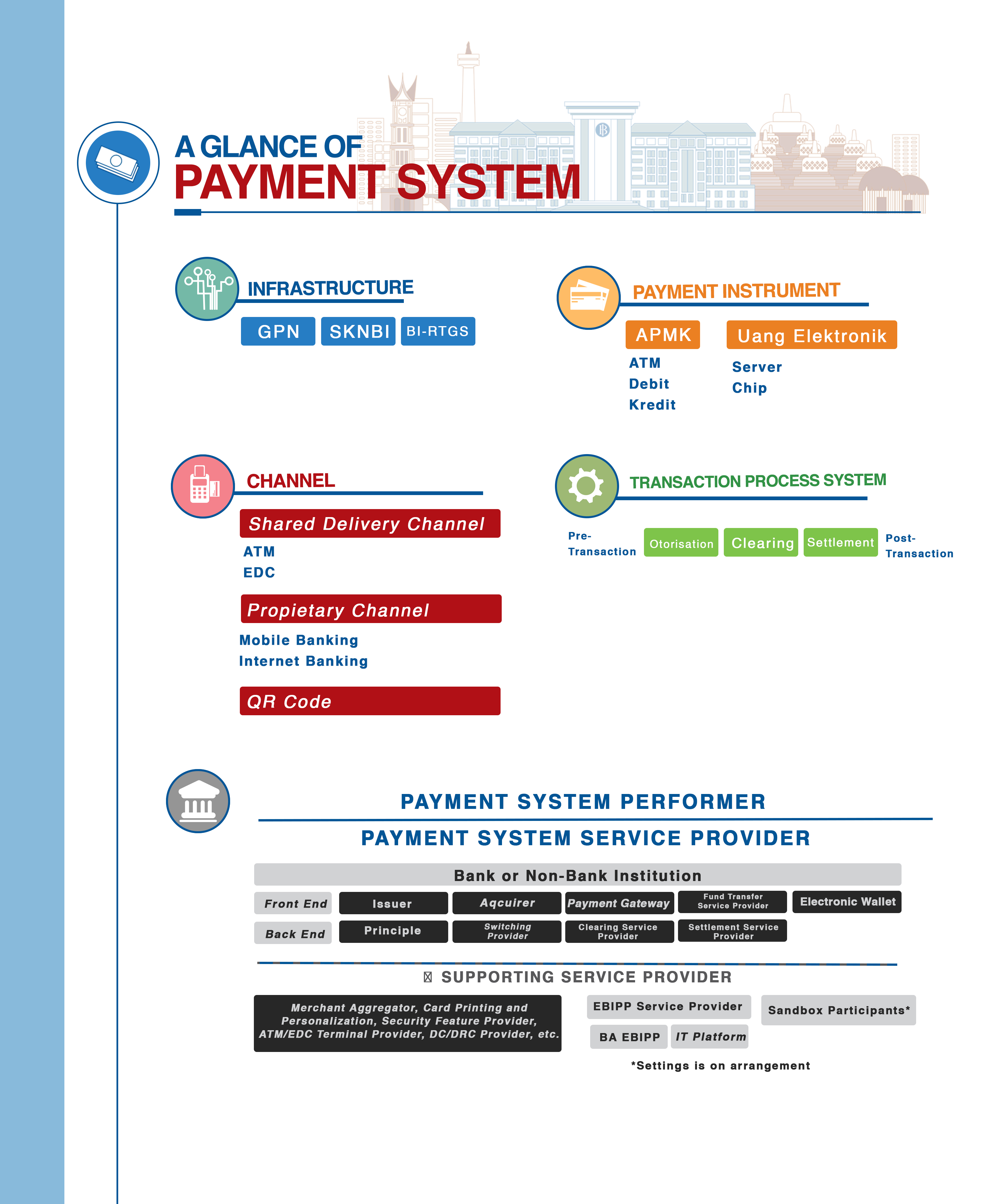

The payment system is a system encompassing regulations, institutions and the mechanisms used to transfer funds in order to settle the obligations that arise from economic activity. The payment system was conceived at the same time as the concept of money as a medium of exchange or intermediary in the transactions of goods, services and finance. In principle, the payment system has three processing stages, namely authorisation, clearing and settlement.

Evolution of The Payment System

The payment system continues to evolve in line with the evolution of money, driven by three salient factors, namely technological innovation and business models, public traditions and the policies of the respective authorities. Initially, payment instruments were dominated by the barter system of trade. Issues only arose when two people willing to trade could not agree a value of exchange or if the double coincidence of wants was not met.

Seeking to overcome those limitations, humas developed commodity money. Commodity money consists of basic necessities with an intrinsic value required by all, such as salt, tea, tobacco as well as various grains. In addition, livestock were used as commodity money between 900-6000 BC. Wheat, vegetables and plants were subsequently used as commodity money after the emergence of agriculture.

Primitive money began to appear around 1200 BC in the form of shells. The Chinese began producing imitation cowrie shells from metal and copper. Ancient paper money can be traced back to white deerskin money in around 100 BC, which was given various colours.

Paper money has become the dominant payment instrument. In Europe, Sweden was the first country to use paper money in 1661, after Spain established a paper factory in 1150.

![EVOLUSI-SISTEM-PEMBAYARAN-[1]-EN.jpg](https://www.bi.go.id/en/fungsi-utama/sistem-pembayaran/PublishingImages/default/EVOLUSI-SISTEM-PEMBAYARAN-[1]-EN.jpg)

Source: Various sources, processed

Cash Payment System

In general, the payment system is divided into the cash and noncash payment systems based on the instruments used. The cash payment system uses currency (banknotes and coins) as a payment tool.

Noncash Payment System

The noncash payment system uses card-based payment instruments, cheques, funds transfers, debit notes as well as card-based and server-based electronic money. The cashless payment system includes wholesale and retail transactions.

Wholesale transactions are characterised by their importance and urgency, including interbank transactions, financial market transactions as well as transactions with a ticket size exceeding Rp1 billion. The infrastructure used to process such transaction activity includes the Bank Indonesia – Real Time Gross Settlement (BI-RTGS) system and Bank Indonesia – Scripless Securities Settlement System (BI-SSSS). On the other hand, retail transactions are lower value, higher frequency transactions between individuals with a ticket size of less than Rp1 billion. The infrastructure used to process retail transactions is the National Clearing System (SKNBI).

Dynamic Evolution

Payment instruments in Indonesia have developed rapidly from cash-based to cashless instruments, including paper-based instruments such as cheques and funds transfers through clearing/settlement, as well as paperless instruments such as electronic funds transfers and card-based payment instruments (ATM/debit cards, credit cards, pre-paid cards).

Over the past decade, a wave of digitalisation has penetrated people's everyday lives, prompting a dramatic behavioural change. Payment instruments have become more diverse with the emergence of chip-based and server-based electronic money. In addition, the pattern of public consumption has begun to shift, thus demanding fast, secure and mobile payments through various platforms, including the web, mobile, unstructured supplementary service data (USSD) and SIM Toolkit (STK).

Most recently, virtual currency instruments have appeared as digital currency issued by third parties, not the monetary authority, obtained through mining, purchasing and rewards. Holding a virtual currency is high risk and speculative due to the lack of an official administrator or underlying assets and a highly fluctuating trade value, exposing the currency to the risk of bubbles and abuse in terms of money laundering and terrorism financing, which influences financial system stability and can incur public losses.

Therefore, Bank Indonesia would like to remind everyone that selling, buying or trading virtual currencies are forbidden in accordance with Bank Indonesia Regulation (PBI) No. PBI 18/40/PBI/2016 concerning Payment Transaction Processing and Bank Indonesia Regulation PBI 19/12/PBI/2017 concerning Financial Technology.

Payment System Development

Recently, the dynamics of everyday life have engendered a new mindset that is developing over time. When a payment mechanism is required to accommodate all of the public's needs in terms of transferring funds quickly, securely and efficiently, payment technology innovations emerge more rapidly. Nevertheless, Bank Indonesia is required to constantly ensure that payment system development exists within the prevailing regulatory corridor in order to ensure uninterrupted and secure payment system activities.

Reflecting such conditions, payment system development is inextricably linked to infrastructure technology innovations, thus payment system development in Indonesia is currently oriented towards strengthening the infrastructure and system development supported by IT advancements. The payments industry, including banks and nonbanks, is competing to develop the payment system. In fact, the contribution of nonbanks in terms of payment system operation is currently expanding as more nonbanks cooperate with the banking industry as network providers and potential issuers of payment instruments.

As a provider of settlement services through the Bank Indonesia – Real Time Gross Settlement (BI-RTGS) system, National Clearing System (SKNBI) and Bank Indonesia – Scripless Securities Settlement System (BI-SSSS), Bank Indonesia constantly strives to improve and update the existing mechanisms in order to safeguard efficiency and security in line with technological advancement and the developing needs of the public.

The public now has a diverse choice of payment instruments at its disposal. A shift has occurred from paper-based instruments, such as cheques and funds transfers, towards card-based and electronic-based instruments as the public becomes more familiar and accustomed to using ATM/debit cards and credit cards as well as chip-based and server-based electronic money as payment instruments.

As operator, Bank Indonesia has strengthened payment system infrastructure through the operation of payment versus payment (PvP) settlement services in the Bank Indonesia – Real Time Gross Settlement (BI-RTGS) system, meaning that foreign currency transactions, specifically United States dollars (USD), against the Indonesian rupiah (IDR), are settled simultaneously, which avoids settlement risk when exchanging currencies. In addition, as payment transactions become less restricted moving forward, economic players will require more liquidity, with the emergence of various derivatives of global financial products and the elimination of regional economic borders through regional cooperation, such as the ASEAN Economic Community (MEA).

In addition to PvP, Bank Indonesia has also strengthened payment system infrastructure by incorporating the settlement function for securities in the Bank Indonesia – Scripless Securities Settlement System (BI-SSSS) into the payment and settlement system of Bank Indonesia. This has increased settlement efficiency and strengthened infrastructure and human resources, culminating in higher quality services for Bank Indonesia's stakeholders.

On the retail side, Bank Indonesia has refined the National Clearing System (SKNBI) in order to minimise credit risk in terms of debit clearing. The application of no money no game principles in the debit clearing process requires banks to maintain an adequate pre-fund to meet payment obligations to other banks. Consequently, clearing participants apply more efficient liquidity management.

Still on the retail side, payment industry development is oriented towards the creation of interoperability amongst the systems used in order to ensure payment system security and efficiency. National standardisation of ATM/debit cards is one example of this. Motivated by security issues when using ATM/debit cards, the shift to chip technology is expected to minimise fraud cases involving ATM/debit cards. In addition, interoperability has also been achieved amongst electronic money operators.

Bank Indonesia has already stipulated five visions for the payment system in Indonesia by 2025. As a quick win towards the manifestation of those visions, Bank Indonesia applies operational policy for the National Clearing System (SKNBI) that meets public and industry requirements while maintaining consumer protection principles.

Payment System Policy Development

The orientation of payment system policy and development began to shift around 10 years ago, from payment system infrastructure development operated directly by Bank Indonesia towards a payment system industry regulatory and institutional regime, particularly in terms of the retail payment system which has been severely impacted by the flow of digitalisation.

-en.jpg)

Notes:

SPBI Milestones

Regulatory and Institutional Milestones

*Six bank participants located in Batavia, namely Nederlandsche Handel Mij Factorij, De Hong Kong and Shanghai Banking Corp., De Chartered Bank of India, Australia and China, De Nederlandsche Indische Escompto Mij, De Nederlandsche Indische Handelsbank and De Javasche bank

**Participants: Eight Clearing Participants (BRI, BDN, BII, BCA, Bank Bali, Deutsche Bank, Standard Chartered Bank and Citibank) and two internal participants from Bank Indonesia (Thamrin Accounting and Kota Accounting).

Supporting economic activity, Bank Indonesia is avowedly committed to providing rupiah currency throughout the territory of the Republic of Indonesia as required by the public. The distribution of rupiah currency is constantly strengthened to ensure balanced and equitable economic growth throughout the archipelago. The structure of the currency distribution network has been optimised through 12 cash depots, which act as hubs for all Bank Indonesia representative offices.

Furthermore, Bank Indonesia also cooperates with the National Police and Armed Forces to secure the currency distribution channels throughout the territory of the Republic of Indonesia. Cash handling services are also regularly enhanced in synergy with the banking industry, including the prompt withdrawal of currency no longer fit for circulation. Cash handling services have been prioritised in areas with limited access and proximity to Bank Indonesia representative offices. In addition, premium cash services are also provided during emergency or disaster conditions in order to maintain economic activity.

Indonesia Payment System Blueprint for 2025: Navigating the National Payment System in the Digital Era

Indonesia has absorbed an influx of digitalisation, creating massive future potential. The digitalisation trend has impacted the structure of the economy, changed the pattern of individual and corporate transactions as well as disrupted conventional functions, with the financial sector no exception.

The current trend of economic and financial digitalisation in Indonesia has created a number of opportunities and risks. Digital technology development and innovation have facilitated convenient, rapid and efficient payment system development and have created vast opportunities for economic and financial inclusion. Notwithstanding, such advancements are not without risk, including cyber security risk, anti-money laundering and counter-terrorism financing (AML/CTF) and protectionism in terms of data exploitation. In addition, the tendency to monopolise the digital ecosystem has left it vulnerable to market control and data misuse, which could disrupt financial system stability. Another significant risk is the potential loss of conventional banking and the emergence of shadow banking that can seriously undermine monetary policy effectiveness.

The policy challenges facing the economic and financial authorities in the digital era, Bank Indonesia in particular, include striking an appropriate balance between efforts to optimise the opportunities afforded through digital innovation with efforts to mitigate the inherent risks.

To that end, the Indonesia Payment System Vision and Indonesia Payment System Blueprint for 2025 provide an unambiguous direction in terms of exploiting digitalisation, while implementing Bank Indonesia's mandate in terms of currency in circulation, monetary policy and financial system stability.

The five visions for the Indonesia Payment System include: First, supporting national digital economy and finance integration in order to safeguard the central bank functions of currency in circulation, monetary policy and financial system stability, while supporting financial inclusion. Second, supporting banking industry digitalisation as the dominant force of the digital economy and finance through open banking and utilisation of digital technology and data in the finance business. Third, safeguarding interlinkages between FinTech and the banking industry in order to mitigate shadow banking risk by strengthening digital technology (Application Programming Interface – API), business cooperation and corporate ownership. Fourth, safeguarding the balance between innovation and consumer protection, integrity and stability, as well as healthy competition through Know Your Customer (KYC) principles, Anti-Money Laundering and Combatting Terrorism Financing (AML/CTF), openness and disclosure in terms of data/information/public business, and the implementation of RegTech and SupTech for reporting, regulation and supervision. Fifth, safeguarding the national interest in terms of the cross-border digital economy and finance through mandatory domestic transaction processing as well as cooperation between foreign and domestic operators and service providers, while maintaining reciprocity principles.

.jpg)

Manifestation of the five visions for the payment system will be realised through five initiatives to be implemented directly by Bank Indonesia as well as through collaboration and coordination with other relevant authorities and industries. The first initiative is open banking and interlinkages between the banking industry and FinTech, as realised through open API standardisation, which facilitates secure financial information disclosure between banks, FinTech and third parties.

The second initiative is retail payment development oriented towards real-time 24/7 operation, with greater security and efficiency, achieved through fast payments, National Payment Gateway (NPG) optimisation and unified payment interface development.

The third initiative involves wholesale payment development and financial market infrastructures (FMIs). The purview of the third initiative encompasses several developments, including RTGS. The fourth initiative talks about data, in this case the collaborative and integrated development of national data for optimal benefit. The final initiative involves regulations, oversight, licensing and reporting to accelerate the digital economy and finance.

Through the Indonesia Payment System Blueprint for 2025, digital innovation is expected to sustainably create access to formal financial and economic services for 83.1 million unbanked and 62.9 million SMEs. Therefore, the full panoply of efforts is currently directed towards a stronger and more equitable future for Indonesia moving forward.

Which Clearing House Settles Mobile App Payments

Source: https://www.bi.go.id/en/fungsi-utama/sistem-pembayaran/default.aspx

Posted by: hookthonegive.blogspot.com

0 Response to "Which Clearing House Settles Mobile App Payments"

Post a Comment